Hint: This website is not optimized for your browser version.

Electricity trade in January and February 2019

18 March 2019 – In January and February, Germany again exported more electricity than it imported. Net exports rose by 6.3% compared with the same period of the previous year. The largest importers of electricity produced in Germany were Austria, France and the Netherlands. The wholesale price of electricity averaged €46.27/MWh, which is significantly higher than the average price in the same period of the previous year.

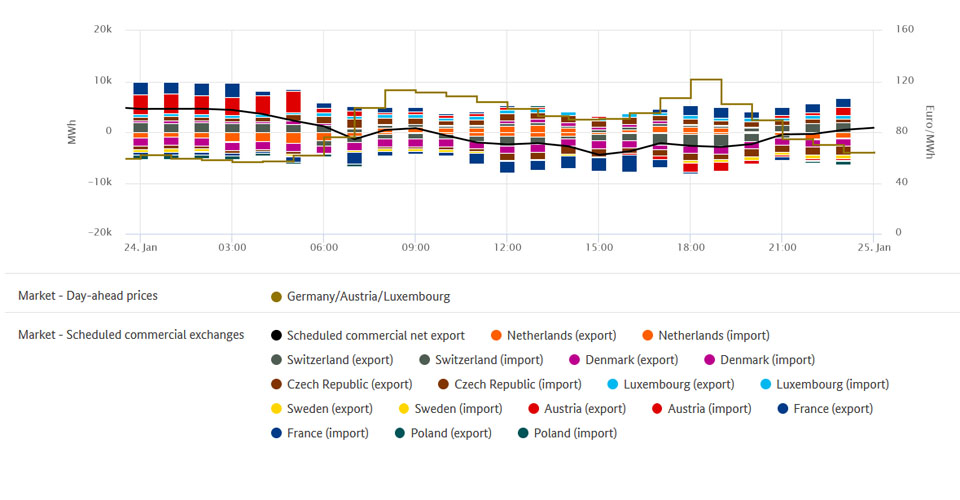

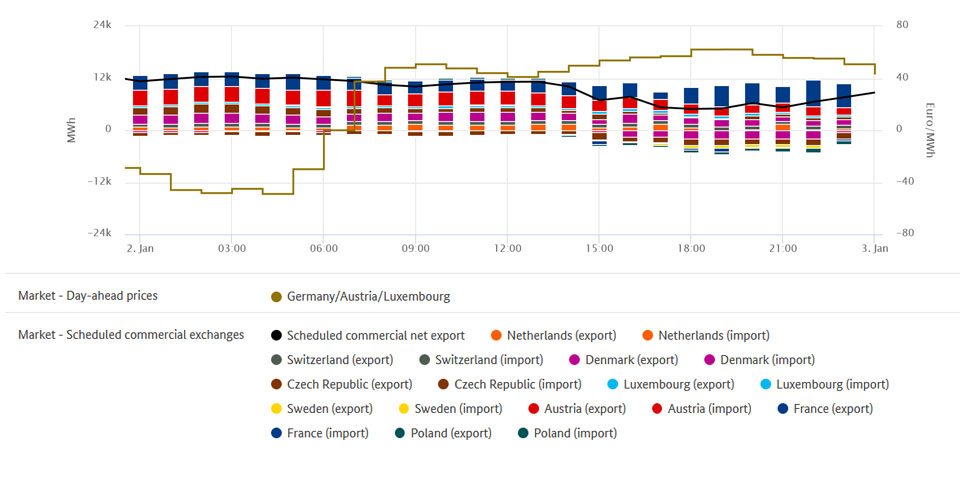

In January and February 2019, Germany's commercial net exports amounted to 12.5 TWh. This is equivalent to 13.1% of the electricity generated in Germany during that period. In comparison with a year earlier, net exports have risen by 6.3%. The main customer for Germany's net exports (exports less imports) was Austria, which accounted for 4,530 GWh (down 7.9% compared with the previous year). France followed in second place with 3,841 GWh (up 12.2%), ahead of the Netherlands with 1,565 GWh (down 18.5%). The changes in exports cannot always be traced back to individual events. Rather they are the result of recurring short-term price fluctuations, which reflect the usual interaction between offer and demand in the respective countries. The decline in net exports to Austria, however, can also be traced back to the introduction of congestion management on 1 October 2018.

In January and February 2019, Germany was also a net exporter to Czech Republic and Denmark, whereas in the previous year Germany had imported electricity from the two countries. A clear rise in the average wholesale price when compared with the previous year was noted for both countries, making imports from these countries less attractive.

Germany was only a net importer of electricity from Sweden, with net imports totalling 74.6 GWh. Compared with the previous year, this was a reduction in imports of 70.2%. This is due to fluctuations in price differences between the two countries. For instance, the number of hours in which the price of electricity in Sweden was below that of Germany, thus making it sensible to import electricity from Sweden, was noticeably less than in the previous year.

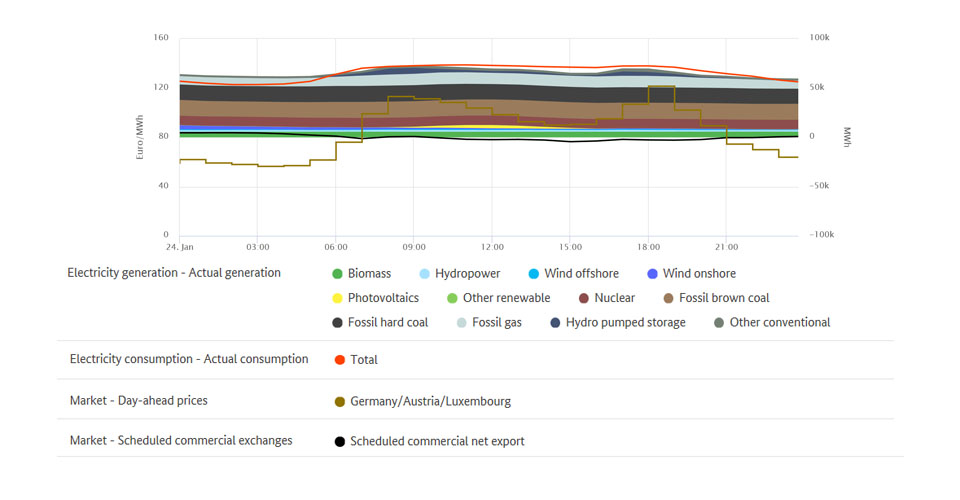

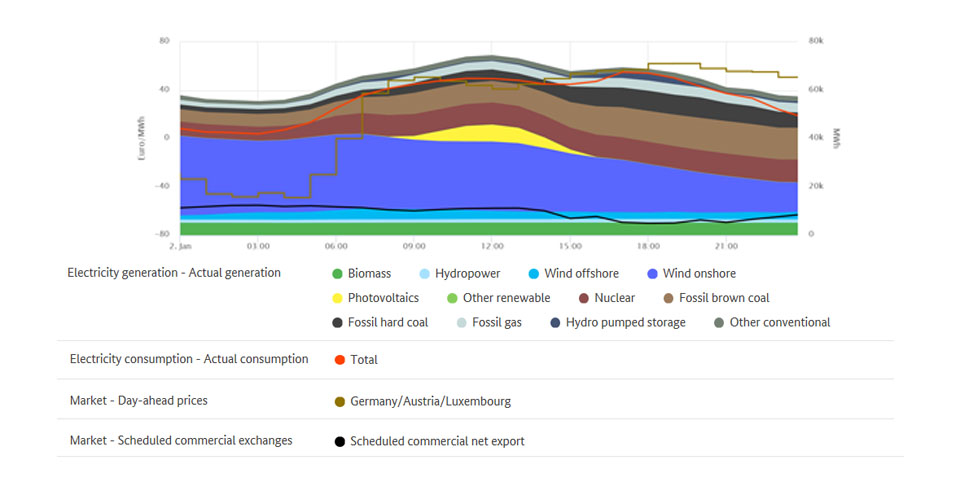

These observations can be presented in a chart using SMARD's market data

The chart gives an overview of Germany's commercial electricity trade. (Gross) exports are shown above the zero line while (gross) imports are shown below the zero line.

The wholesale price in Germany

Wholesale prices for electricity were higher compared to a year earlier. In January and February the hourly products on the EPEX Spot day-ahead market were traded at between 48.93 euros and 121.46 euros per megawatt hour (€/MWh), resulting in an average price of €46.27/MWh. That was €11.76/MWh higher than in the same period of the previous year.

On the day-ahead market exchange, the highest price of the past two months of €121.46/MWh was recorded on Thursday, 24 January, between 6pm and 7pm. At that time relatively high electricity consumption coincided with extremely low wind infeed and the winter evening lack of PV feed-in. Consequently, the more expensive conventional energy sources were then responsible for producing a large amount of the electricity supply in Germany. The additional German energy requirement of 2.7 GWh was imported from Austria, Sweden, Czechia, Denmark and Switzerland.

At the time of the lowest electricity price of ‑48.93 €/MWh between 4am and 5am on Wednesday, 2 January, relatively low consumption coincided with relatively high wind infeed. A large amount of electricity was exported abroad. Net exports amounted to 11.9 GWh.