Hint: This website is not optimized for your browser version.

Energy market topics

Assessing high wholesale electricity prices

6 December 2021 - Wholesale electricity prices have increased significantly compared with 2020. The causes are an increase in electricity consumption and higher generation costs of conventional power stations with less power being generated from renewables.

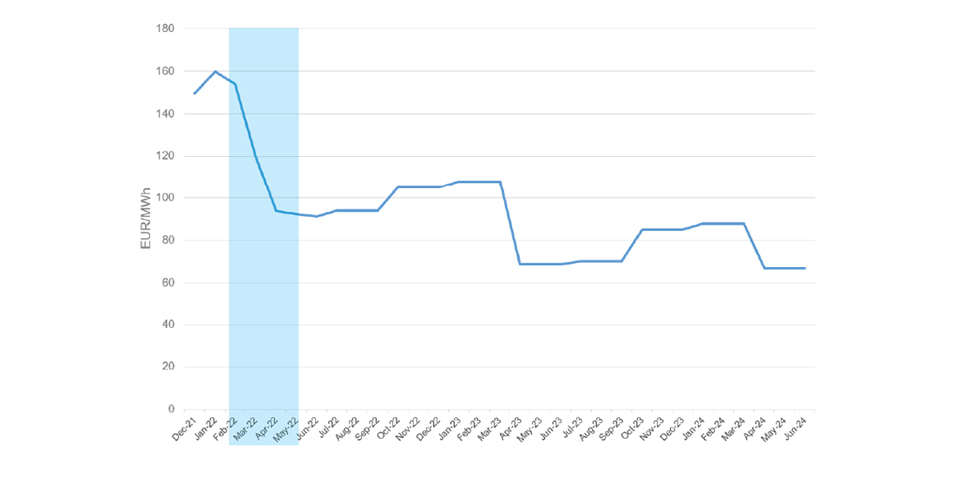

The average German wholesale electricity price on the EPEX Spot day-ahead market of €85.31/MWh from January to November 2021 was more than twice as high as in 2020 (€29.26/MWh). For a further comparison, the average price for the period from January to November 2019 was €38.20/MWh,

In November 2021 electricity was traded on the wholesale market at an average price of €176.15/MWh.

Factors affecting wholesale electricity prices

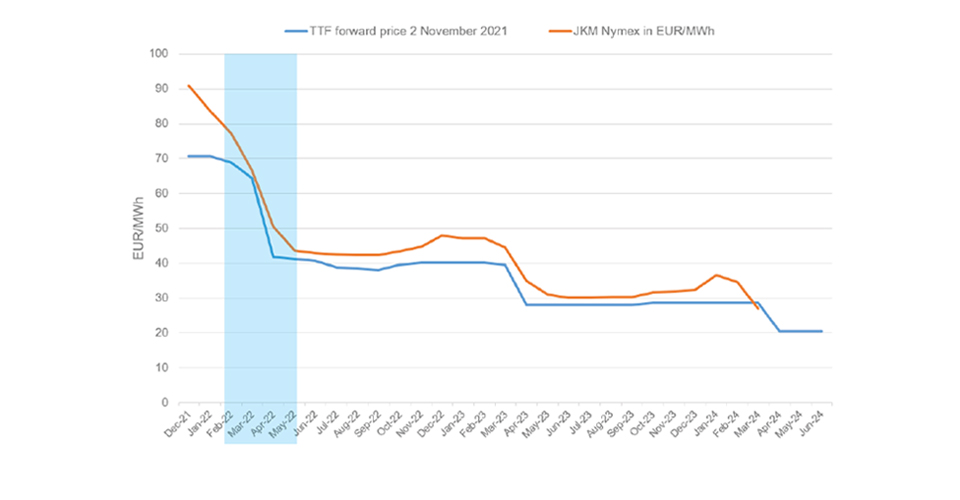

In the second half of 2021, gas and electricity wholesale prices in the EU rose significantly. Average gas prices in October were around 400% higher than in April 2021. Wholesale electricity prices in the same period were up by an average of 200%.

The main cause of the generally high wholesale electricity prices in Europe is rising fuel prices, particularly for natural gas, around the world. The rising fuel prices themselves are caused by an increase in demand when at the same time there is a shortage of supply and storage levels are low. Asian demand for liquefied natural gas (LNG) has increased markedly, which has driven up world market prices and resulted in less gas being available for imports to Europe. LNG imports into the EU up to September 2021 were down by 20% compared with 2020. Because LNG is the price setter on many EU gas markets, this also leads to a price increase for gas transported through pipelines.

Another factor affecting prices is the significant increase in the price of EU carbon emission allowances since the beginning of the year. For example, in November 2021 an emission allowance for one tonne of CO2 was traded at an average of €65.68. In November 2020 the price on the EEX energy exchange was just €26.57/t CO2. The EU's stricter climate protection targets are increasingly reflected in emissions trading. Anticipating a shortage of allowances, a rise in demand from the market participants caused the price to increase.

The relative profitability of gas-fired power plants has also declined compared with coal-fired plants due to higher gas prices. The competitiveness of coal-fired power plants has increased accordingly in spite of the high costs of emission allowances. The cost advantage of gas-fired power plants from the lower demand for emission allowances has been superseded by the higher costs of gas. This is reflected in a higher level of electricity generation from hard coal and a lower level of electricity generation from natural gas compared with last year (see Electricity generation and electricity trading in October 2021).

Another reason for the rise in wholesale electricity prices compared with the first half of last year is the increased electricity consumption. Last year, the measures taken from mid-March onwards to contain the Covid-19 pandemic led to a significant decrease in consumption. Low demand in 2020 was a significant factor behind the low price level.

In addition, generation from renewable energy sources from January to November 2021 was down by around 8.4% compared with 2020. Generation from wind, in particular, was lower. Onshore wind generation was down by 15% and offshore wind generation was down by 11.6%.

The overall figures for renewable generation are also comparatively lower because output in 2020 was unusually high. Renewable generation from January to November 2021 was only 2.4% lower than in 2019, for example. Consequently, renewables had a smaller price-dampening effect than in previous years.

Higher prices for carbon allowances and fuel make the generation costs for electricity from fossil fuels more expensive. This results in higher wholesale prices when combined with higher electricity consumption, especially in periods with lower generation from renewables.

Potential impact on retail prices and the outlook for 2022

Retail prices for electricity and gas in Germany are largely contracted for longer periods, meaning that consumers pay the prices they contractually agreed to, regardless of price changes on the exchange. Energy utilities, by contrast, usually purchase electricity on the futures market for the long term. That is why short-term price changes on the wholesale market only have a delayed effect on retail prices. Only the electricity procured by energy utilities at short notice must be purchased at the currently high prices, which can impact the utilities' profitability.

Futures market data provide an outlook for future price trends on the wholesale markets. Thus the price curves forecast that prices for those gas and electricity wholesale contracts to be fulfilled in the medium term will decline significantly from April 2022. The demand for gas is expected to decline along with the end of the winter heating period. At the same time, the market anticipates an increase in supply. The price curves will continue to flatten gradually until June 2024.