Hint: This website is not optimized for your browser version.

Monitoring Report 2023

Preview of consumer figures

13 November 2023 - The turbulence on the energy markets in 2022 caused the prices of default suppliers to fall below those of the other types of contract for the first time. For this reason, there was a large drop in the number of household electricity and gas customers switching supplier during the year. Disconnections were also down despite the higher prices.

The selected key figures presented here focus on the situation of household customers. They will also be included in the upcoming Monitoring Report 2023 published by the Bundesnetzagentur and the Bundeskartellamt and refer to the year 2022. The electricity and gas retail prices stated also reflect levels on the reporting date of 1 April 2023.

The year 2022 was a turning point in the energy sector. The uncertainty caused by Russia's war on Ukraine led to considerable turbulence on the energy markets, which was particularly noticeable for individual electricity and gas consumers in 2023 as prices remained high.

The average electricity price for household customers on 1 April 2023 was a record 45.19 cents per kilowatt hour (2022: 36.06 ct/kWh). It was not possible to include price changes occurring after this date in 2023 in the data survey. The average gas price for household customers was 14.80 ct/kWh on 1 April 2023 (2022: 9.88 ct/kWh), around 50% higher than the previous year. Here, too, subsequent price changes were not included. The rise in retail electricity and gas prices was primarily due to the much higher costs of procuring energy. Electricity and gas prices vary depending on the customer's type of contract. On the reporting date of 1 April, the prices of suppliers that were not the default supplier were lower than the other types of contract again, making it attractive to switch supplier in 2023. In 2022, however, the traditionally somewhat higher default supplier prices had been lower than those of the other types of contract.

Fewer supplier switches than before

The large reduction in supplier switches in 2022 reflected the temporarily low choice of attractive new customer contracts and, as already mentioned, the price trends. There was, for a time, no incentive to move from the usually more expensive default supply to a competitive tariff. The proportion of electricity consumers supplied under a default contract remained around the same as the previous year, but for gas there was a small rise of 2%, the first increase in many years.

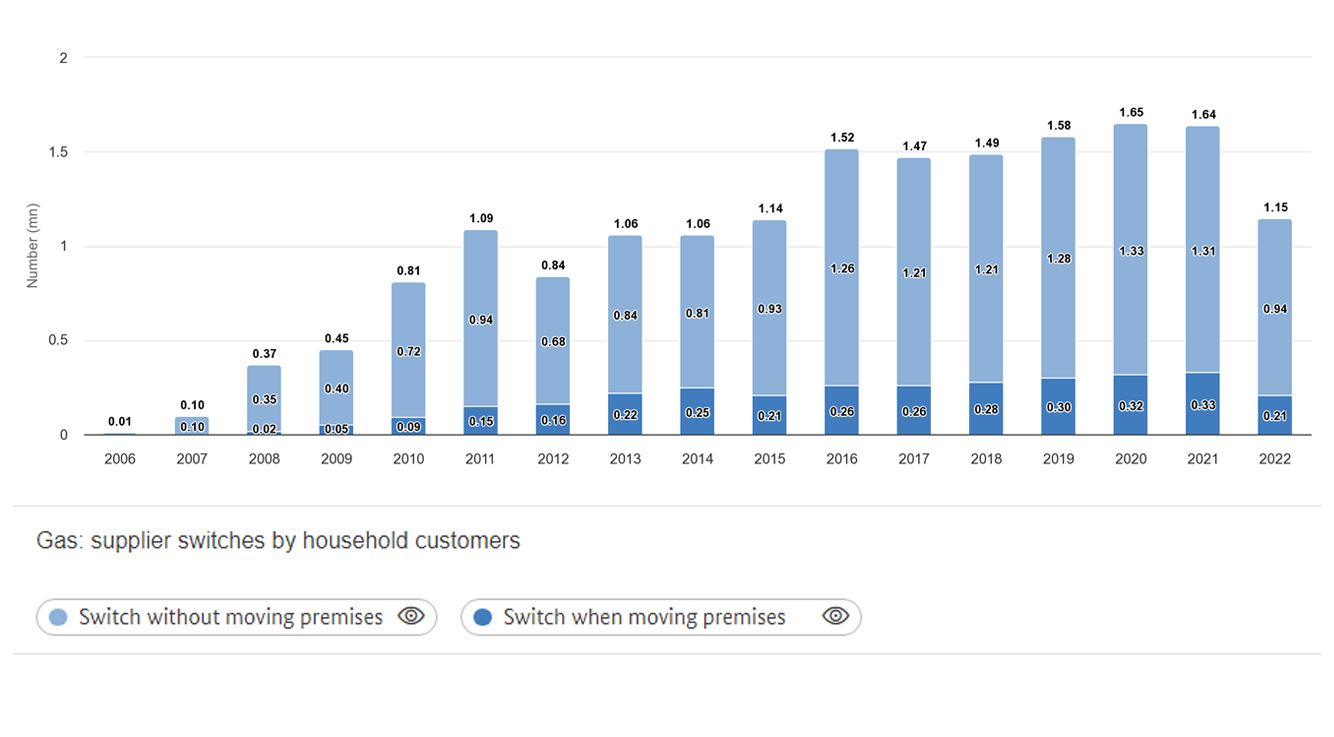

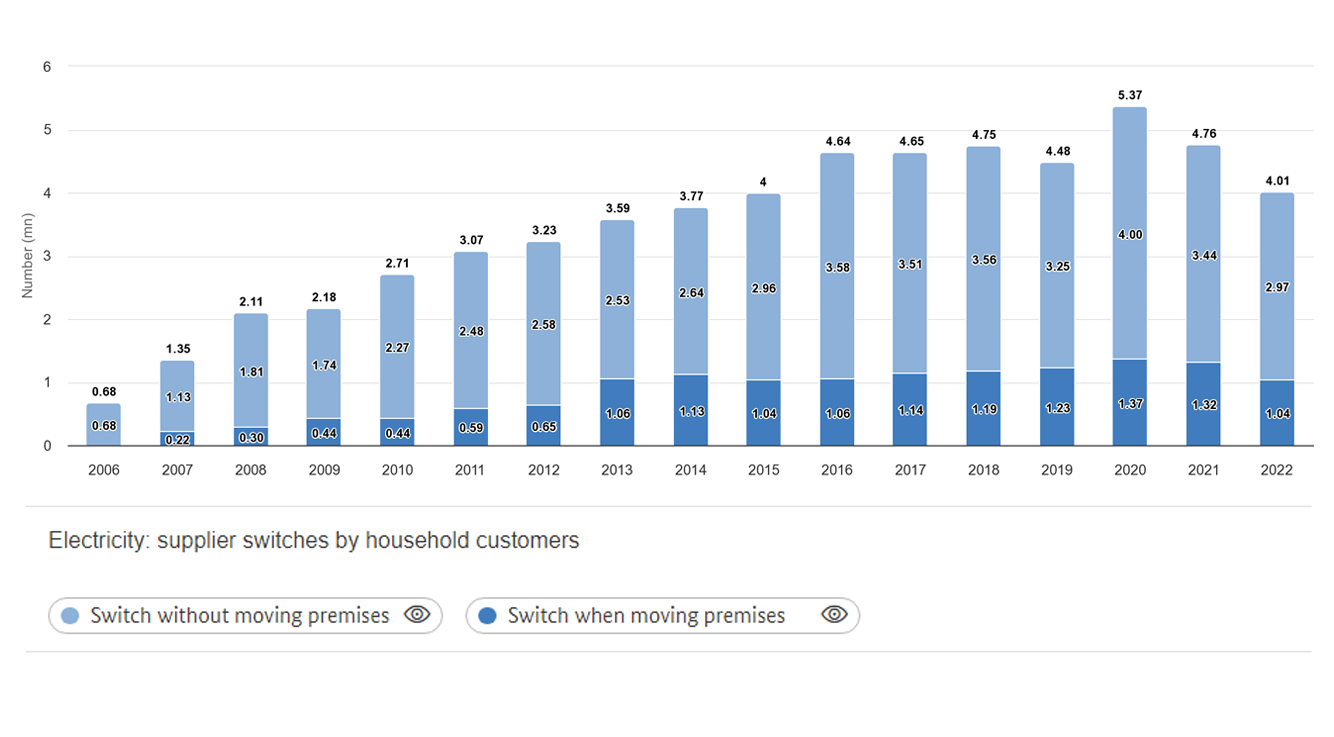

The number of household electricity customers changing supplier dropped considerably in 2022, by about 16% to just over four million. The supplier switching rate, based on the total number of household customers, was 8.2% (2021: 9.7%). The number of household gas customers changing supplier fell by about a third to 1.15mn from 1.64mn. The supplier switching rate, based on the total number of household gas customers, was 8.9% (2021: 12.9%). The highly volatile, sometimes explosive, wholesale gas prices, along with the general uncertainty about the security of gas supply, may also have contributed to the considerable drop in gas customers switching supplier.

Number of disconnections decreased

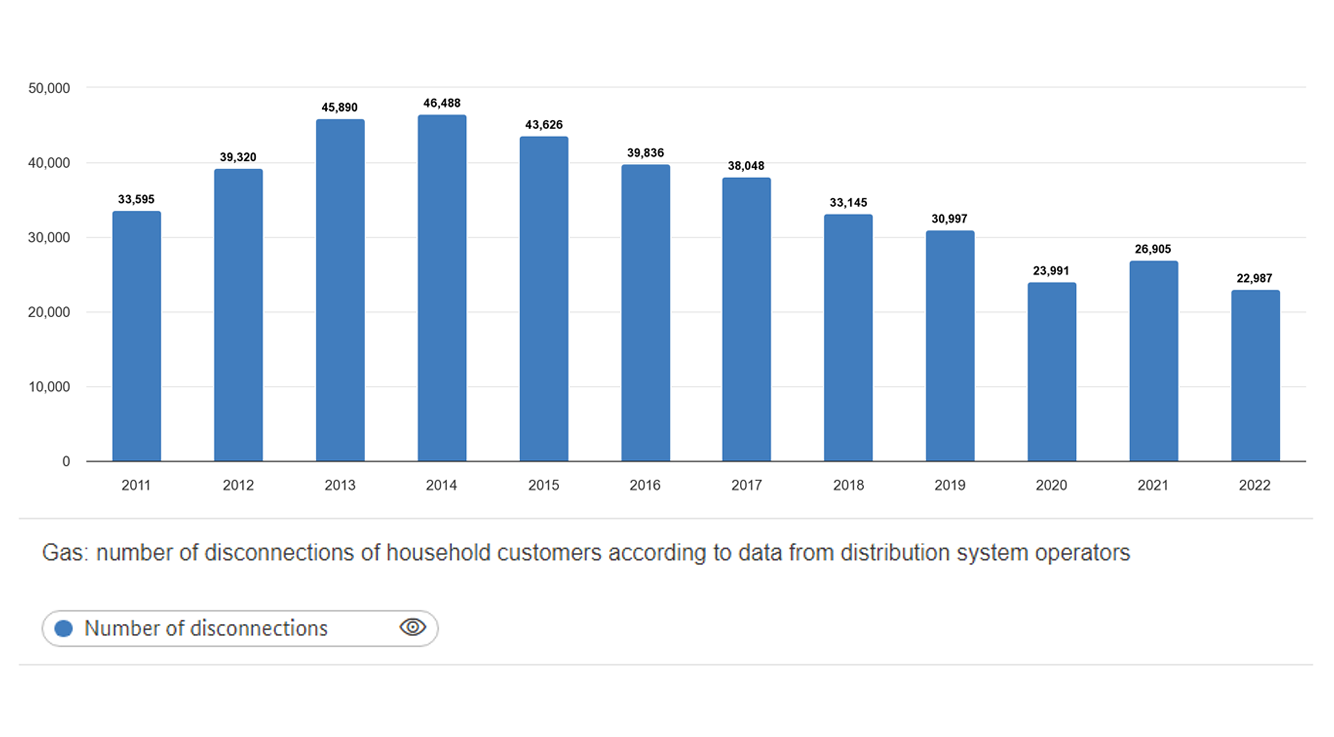

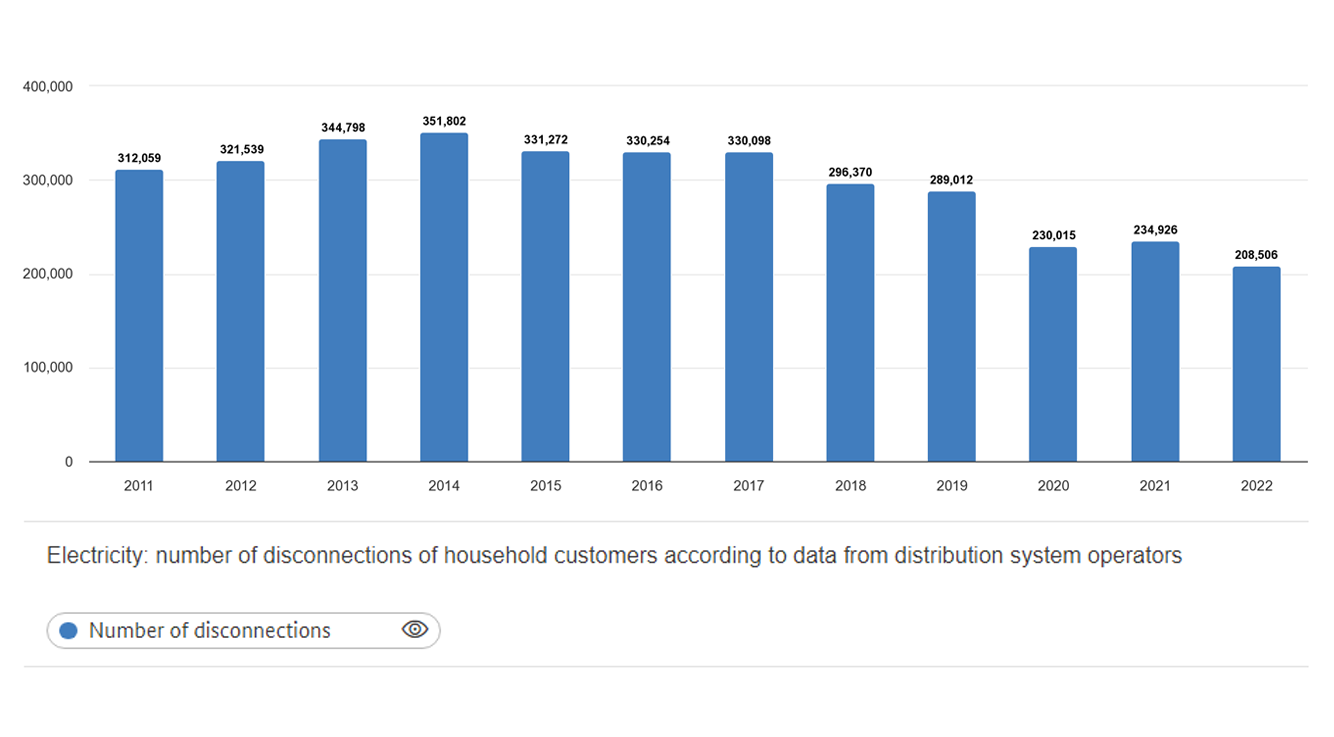

Rising electricity and gas prices usually lead to more supply disconnections in the medium term. Fortunately, the higher prices were not reflected in the disconnection figures for 2022. There were various reasons for this. The majority of energy suppliers chose not to disconnect their customers. Suppliers often accommodated customers by offering them special or individual payment arrangements. There was a large increase in 2022 in the number of customers in payment difficulties being offered payment by instalment.

Disconnections of electricity supply were down just over 11% year-on-year to about 209,000 in 2022 (2021: approximately 235,000). Disconnections in the gas sector fell by about 15%, with around 23,000 reported disconnections in 2022 (2021: about 27,000).

Further analysis of the retail sector may be found in the forthcoming Monitoring Report 2023 published by the Bundesnetzagentur and the Bundeskartellamt. Content from the report will also be made available in interactive form on the SMARD website.