Hint: This website is not optimized for your browser version.

Energy market topics

Electricity market in transition - this is how electricity market 2.0 works

July 1, 2017 – The German electricity market is constantly changing. Until the end of the 1990s, the German electricity market was dominated by regional monopolists. Now it is closely linked to the markets of neighbouring countries. Generation is also undergoing major changes. Germany will phase out nuclear power by 2022. The share of renewables in electricity generation is rising - currently it already accounts for about 30% of consumption and its share is set to increase in the years ahead. In the future, feed-in from solar and wind energy, which varies according to season and time of day, will shape the electricity system. The best response to this trend is flexibility. In the future, flexible producers, consumers and storage facilities will shape the electricity market. With electricity market 2.0, the German federal government is consequently betting on a market design that can ensure the safe, cost-effective and environmentally responsible supply of electricity, even with a high proportion of renewable energy.

The legislature decided to transform the electricity market into an “electricity market 2.0”. What is electricity market 2.0? The key issue is to facilitate fair competition for flexible consumers, producers and storage facilities (known as “flexibility options”), and require electricity suppliers to always purchase enough electricity for their customers. Three arguments support electricity market 2.0. First of all, electricity market 2.0 guarantees security of supply. Secondly, it is cost effective. Finally, it fosters innovation and sustainability.

Electricity market 2.0: making the electricity market fit for the energy Transition

Electricity market 2.0, which is based on the existing market, thoroughly develops and strengthens current market approaches. With the Electricity Market Act that was adopted in 2016, a reliable legal framework was created that investors can trust, which guarantees that security of supply for electricity customers remains high.

Two mechanisms of electricity market 2.0 are especially important. First of all, prices in the electricity market must continue to be set freely and, secondly, electricity suppliers are consistently required to fulfil their delivery obligations. These mechanisms strengthen the existing market-based system and set the right incentives for all players. The market itself can this way provide the necessary capacity through power plants, storage facilities or flexibility options on the demand side. Investors do not have to rely on other payments that are set administratively (known as “capacity markets”). Moreover, capacity markets are extremely complex. They constitute a far-reaching intervention in the market. As various expert reports show, capacity markets can lead to considerably higher costs and are liable to have errors in their design.

Electricity market 2.0 can deliver the necessary capacity and provide the solutions required to integrate renewables in a more cost-effective manner. Flexibility options are especially critical to integrate variable generation from renewable sources. From a technical point of view, the electricity market has sufficient flexibility options, including storage facilities and flexible consumers, to balance generation and consumption at all times.

Since the potential of flexibility options is not only diverse, but also far greater exceeds actual demand, and technologies are constantly being further developed, it is not necessary to single out and support individual technologies. From an economic point of view, cost effective solutions should result from competition that is open to technological innovations. A key to this are prices that are set freely and are ideally undistorted, as they help to attract the best and least expensive flexibility options that are then used in the electricity market.

Because of various barriers present in the energy market’s design, the electricity market is currently sending partially distorted price signals to a number of electricity producers and consumers. This is, for instance, the case within the structure of the fixed components in the the electricity sector and at the interface to the heat and transport sector.

To strengthen the market signal, barriers to flexibility must be reviewed and addressed. The Federal Ministry for Economic Affairs and Energy (BMWi) is continually working to strengthen the market signal.

The European internal electricity market lowers costs and strengthens security of supply

With electricity market 2.0, the BMWi expressly supports the liberalised European internal electricity market. Since the liberalisation of electricity markets back in the late 1990s, increased competition has fostered more cost effective electricity generation and lower wholesale prices. The process of gradually merging and more closely integrating regional and national electricity markets in Europe has begun in recent years. National electricity markets benefit from the option of using cross-border electricity trade to better balance differences in consumption and production. For instance, seeing as winds in Europe are not consistent across the entire continent, other installations can step in and make up for imbalances. Also, peaks in demand do not always occur across Europe simultaneously. Because supply and demand can be balanced out across regions in the internal market, less capacity needs to be kept on standby. In addition, unplanned outages become less likely, because it is easier to manage supply and demand in a larger market and it is easier to compensate for individual lines that fail. This means that security of supply is strengthened and costs for electricity generation in Europe go down.

Transmission capacity and network infrastructure used in trade between EU Member States, although at present limited, will be further expanded in the future to make it possible to further tap into the advantages of European electricity trading. Because of present limits, the right to use transmission capacity at borders is auctioned off or used in “market coupling”. In market coupling, electricity markets of individual countries are coupled automatically. In a coordinated manner, electricity exchanges calculate how transmission capacity can be used optimally. As a result, market coupling has led to prices progressively harmonising across Europe.

The creation of an internal energy market is one of the key components of the Energy Union. The Energy Union strives to further develop the European internal market for electricity and gas in Europe and to make climate-friendly energy supply safe, emit low-emissions and be cost-effective in the long term. In addition to market coupling, this requires making transmission capacity between individual countries available for cross-border exchanges in electricity.

Liberalised electricity market integrates renewables efficiently

A few years before the market was liberalised, European governments already decided to support generation from renewable sources. The first statutory regulations were already present at the beginning of the 1990s. In 2000, the Renewable Energy Sources Act (Erneuerbare Energien Gesetz – EEG) spurred solar and biomass generation in Germany. The share of electricity generated from these sources has increased steadily ever since. In Germany, renewables accounted for roughly 30% of gross electricity generation in 2016. Today, renewables have already become the most important source of electricity in the German energy industry.

The liberalisation of the electricity market benefits the integration of renewables. Just a few years ago, operators of renewable energy installations would receive a fixed feed-in tariff per kilowatt hour of electricity produced. The share of plant operators who sell their electricity independently on the wholesale market has been steadily increasing since 2012. This is because EEG 2012 strengthened the incentive to operate installations in a market-oriented manner. In some cases, “direct sellers” operate these installations as service providers. In addition to the income from the sale of electricity, operators also receive a legally prescribed market premium. This form of marketing electricity has been mandatory for new, larger installations with a capacity of at least 100 kilowatts since mid-2014. This helps integrate renewables into the existing energy system. Operators of renewable energy installations and direct sellers now have a greater incentive to provide projections beforehand of exactly how much electricity they will generate. What’s more, the accuracy of projections has improved in recent years. In particular, intraday trading on the exchange, where transactions are concluded up to shortly before the time of delivery, offers the possibility to react to changes in projections in the short term and balance out differences.

In addition to integrating renewables into the electricity market, grid expansion is another important piece of the puzzle in the process of successfully integrating renewables into the energy system and gradually phasing out nuclear power. Electricity networks play a critical role in the energy transition. Not only is the source of generation changing, but also the geographic distribution of the installations themselves. Indeed, many renewable energy installations have been built far away from the consumption centres of Germany, in sparsely populated areas. The electricity produced there needs to be transported to load centres. This makes new electricity lines necessary.

The path towards a competitive electricity market: monopolies abolished and competition fostered

Until the end of the 1990s, the German electricity market was dominated by regional monopolists. Household customers were only able to buy electricity from their respective regional or municipal utility. The utilities, in turn, produced the electricity themselves or bought it from companies located in their region. They were always the only provider available to households. In addition to the large amounts of capital required to finance infrastructure investments, a decisive obstacle to opening of the electricity market was the fact that network operation and generation were both in the hands of a regional provider that could refuse any potential competitors access to the network and the market.

Central reforms led to the liberalisation of the German and European electricity market in 1998. The corporate divisions of electricity generation, grid operation and electricity distribution had to be unbundled, ie to allow them to act independently on the market. On the legal basis of the Energy Industry Act (Energiewirtschaftsgesetz – EnWG), consumers have been free to choose their electricity supplier ever since and suppliers can offer their services to customers in more than one region. The goal is secure, affordable, consumer-friendly, efficient and environmentally friendly electricity supply that is increasingly based on renewables.

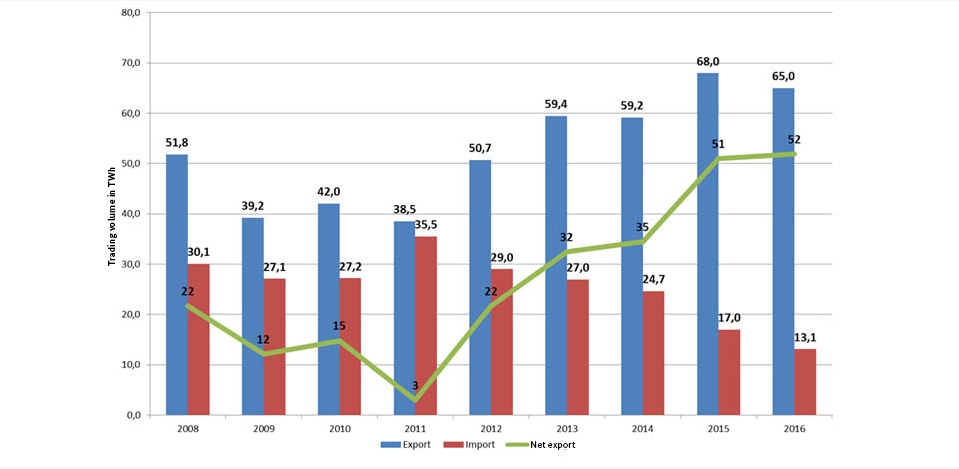

The increase in trade is evident when looking at electricity exports. The biggest increase in Germany’s net exports was between 2011 and 2015. The increase in exports goes hand in hand with falling prices on Germany’s electricity exchanges. The blue bar represents exports while the red bar represents imports. A green line marks the Balance.

In addition, the liberalisation of the electricity market has led to considerably more trade on exchanges and other platforms. A number of new suppliers have appeared on the market as a result. In Germany alone, more than 4,000 companies trade wholesale energy products on the exchanges. This benefits both consumers and the economy, because strong competition helps to lower prices and foster innovations.

Users can follow the current situation on the electricity market live on the SMARD website. In the “Market data visuals” section, you can look up data on generation, consumption, imports and exports, as well as data on balancing services, and combine all these for different periods of time. In the “German electricity market” section, you will find a map of Germany with a list of power plants, an overview of the key figures relating to the electricity market and detailed information on installations generating electricity in Germany.

Articles on current developments, events and trends relating to the electricity market and cross-border trade are published regularly in the "Electricity market topics" section.