Hint: This website is not optimized for your browser version.

Electricity trade in November and December 2019

In the past two months, Germany exported more electricity than it imported. However, net exports fell by 23% compared with the same period of the previous year. The largest importers of electricity generated in Germany were Austria, France and Switzerland. The average wholesale price of electricity was €36.41/MWh, which was significantly lower than the average price in the same period of the previous year (€52.33/MWh).

In November and December, Germany's commercial net exports amounted to 8,645 GWh. This is equivalent to almost 9.8% of the electricity generated in Germany during that period. In comparison with the previous year, net exports fell by 23%. The main customer for Germany's net exports of electricity (exports less imports) was Austria, which accounted for 3,059 GWh (down 34.2% compared with the previous year). France followed in second place with 2,078 GWh (down 24.5%), ahead of Switzerland with 802 GWh net (down 48.5%).

Germany was only a net importer from Sweden, from which it took 43 GWh, a clear drop on last year's 287 GWh. One reason for this is that the German price was lower than the Swedish one more often – in 683 of 1,464 traded hours during the period, or nearly 47% of the time. At those times, German exported electricity to Sweden. In November and December 2018, the German price was only lower for 322, or 22%, of the 1,464 traded hours.

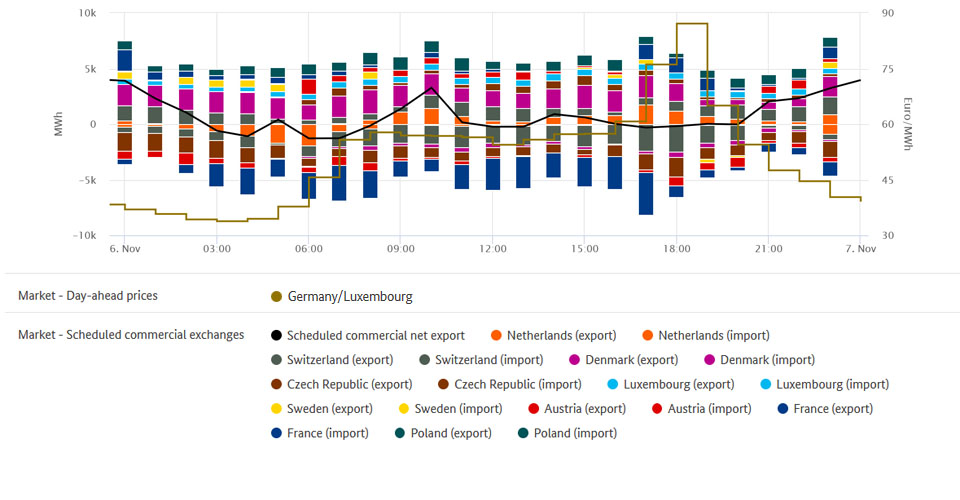

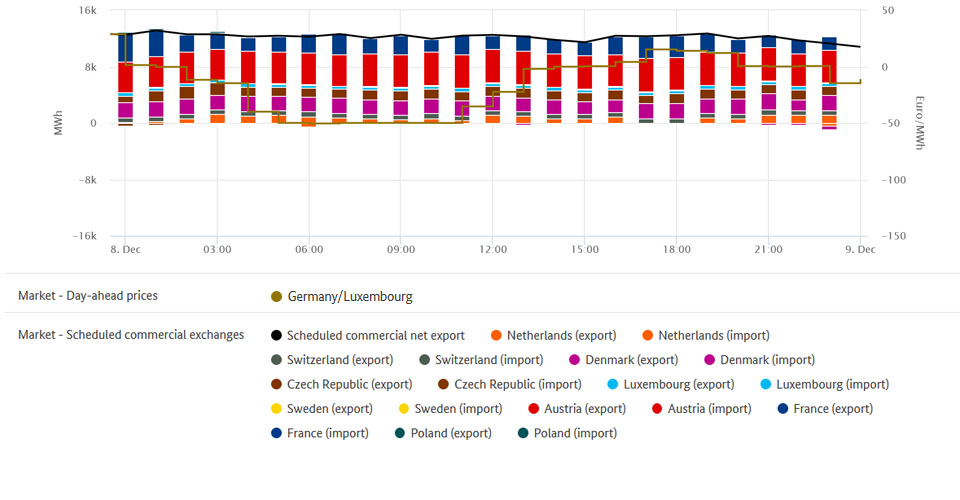

These observations can be presented in a chart using SMARD's market data

The chart gives an overview of Germany's commercial electricity trade. (Gross) exports are shown above the zero line while (gross) imports are shown below the zero line.

There has been a year-on-year drop in net electricity exports from Germany every month since February 2019; in June and August, Germany was actually a net importer. The downwards trend continued in November and December.

Changes in imports and exports are the result of frequent short-term price fluctuations, which reflect the interaction of supply and demand in the respective countries and across borders. These fluctuations are part of normal market activity in the European wholesale electricity trade.

Monthly net exports from Germany from 1 January 2018 to 31 December 2019

Switzerland may be used as an example to illustrate the influence of wholesale market price differences on imports and exports with Germany. In November and December, average electricity prices dropped year-on-year in both countries, but more sharply in Germany. While a megawatt-hour of electricity in Switzerland cost an average of about €43.35 (2018: €61.38), in Germany it only cost an average of €36.41 (2018: €52.33/MWh). The price adjustments become even clear if the months of November and December 2019 are looked at separately. In November, the average price gap between Germany and Switzerland was still relatively small (Switzerland: €45.94/MWh; Germany: €41.00/MWh), but it widened considerably in December (Switzerland: €40.85/MWh; Germany: €31.97).

The price in Germany was cheaper than in Switzerland for 1,142 of a total of 1,464 traded hours, lower than last year's figure of 1,217 hours. Net exports from Germany to Switzerland were down significantly, from 1,559 GWh to 802 GWh.

As in Germany, wholesale prices in Austria were also much lower than in the same period of the preceding year. Net exports fell from 4,700 GWh to 3,095 GWh. One possible reason for the lower exports is the lower number of hours in which the price in Germany was below that of Austria (down to 806 from 1,077 hours). There had been a drop in net exports in the year before as well. That was due in particular to the introduction of the congestion management scheme between Germany and Austria.

The wholesale price in Germany

Compared with the previous year, wholesale prices for electricity fell. In November and December, the hourly products on the EPEX Spot day-ahead market were traded at between 87.12 and minus 50.43 euros per megawatt hour, resulting in an average of €36.41/MWh. That was €15.92/MWh less than in the same period of last year. One reason for the fall in wholesale prices is the doubling in the number of negative prices (2018: 41, 2019: 88), which brought down the average.

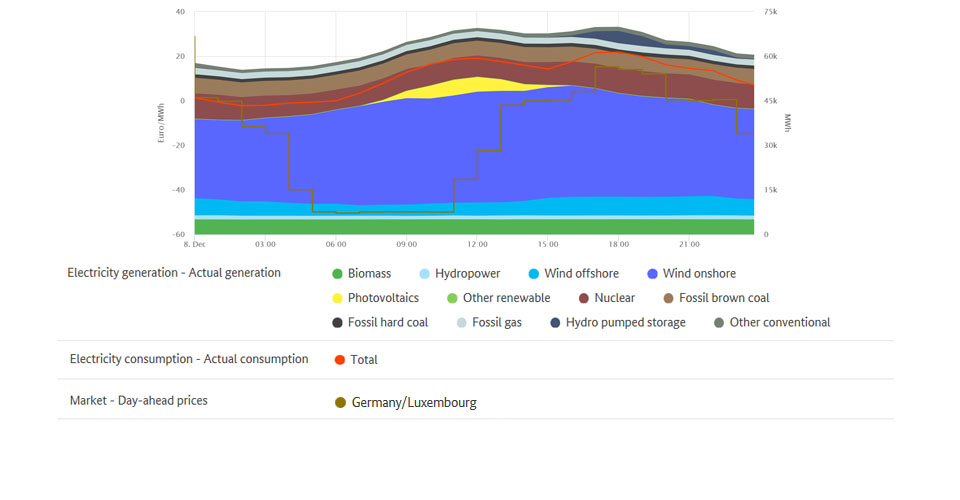

The lowest exchange price occurred between 6am and 7am on Sunday, 8 December and was minus 50.43 euros per megawatt hour. During that time, electricity consumption was low and at the same time, there was a large amount of feed-in from renewable energy sources, in particular from onshore wind turbines.

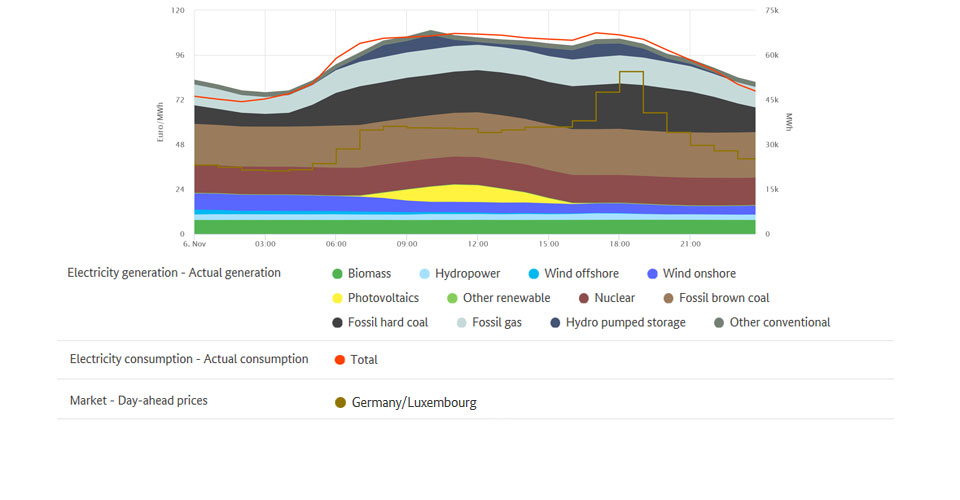

On the day-ahead market exchange, the highest price of the past two months of €87.12/MWh was recorded on Wednesday, 6 November, between 6pm and 7pm. At that time, consumption was high and there was a low level of generation from renewables. The electricity market reacts to this kind of situation by taking power from storage facilities (eg pumped storage stations), reducing the consumption of flexible loads and increasing use of conventional power stations with higher marginal costs, in particular gas-fired power plants.