Hint: This website is not optimized for your browser version.

The electricity market in the third quarter of 2023

Wholesale electricity price again lower

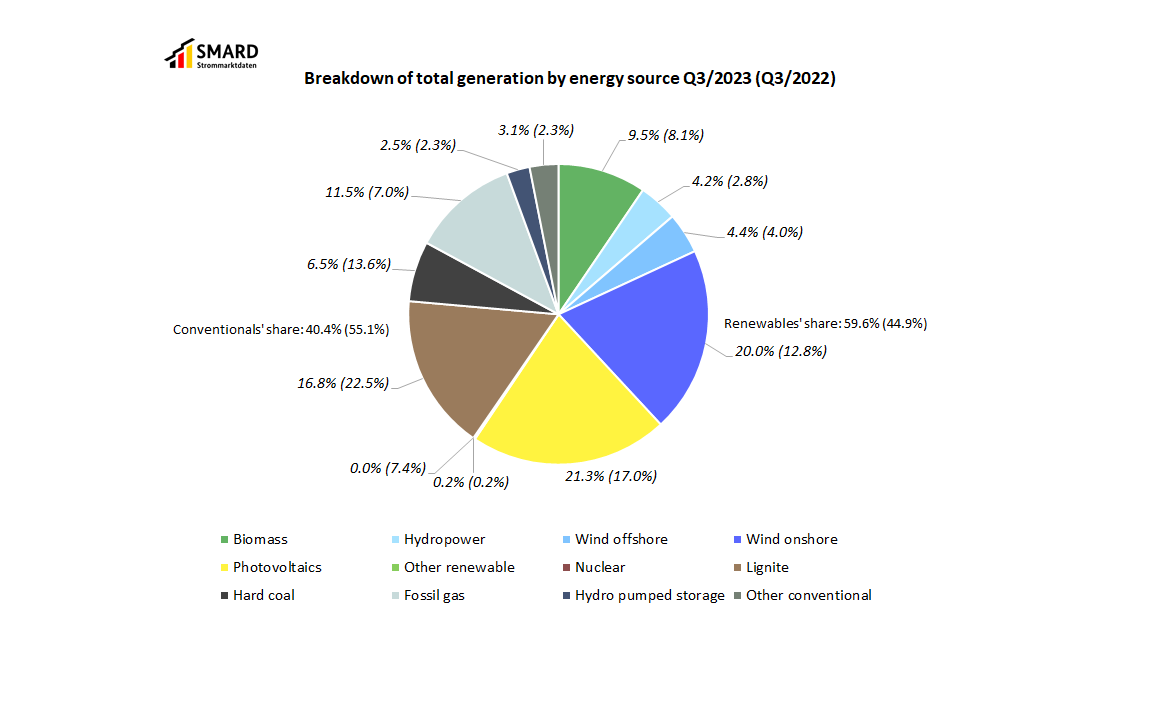

3 November 2023 – Renewables' share of electricity generation in the third quarter of 2023 was 59.6%. Electricity consumption was 3.1% lower than in the same quarter of last year. The average wholesale electricity price (€90.78/MWh) was significantly lower than in the same period of the preceding year. Germany was a net importer in commercial foreign trade.

Electricity consumption (grid load) continued to decrease. It was 3.1% less overall than in the same quarter of 2022.

Onshore wind generation up by 28.6%

In the past quarter there was a 28.6% increase in total feed-in* from onshore wind installations. Favourable weather conditions particularly in July (DWD) resulted in high generation levels. In addition, installed capacity increased by 2.3 GW compared to the third quarter of 2022.

At the same time there was an 8.2% decrease in generation from offshore wind installations. The main reason for this was the lack of availability of individual interconnectors and wind farms due to maintenance work.

Feed-in from solar installations was up by 3.6% compared with the third quarter of 2022. Weather conditions and a 5.3% increase in installed generating capacity each played a role here.

Generation from hydropower was 22.3% higher than in the same quarter the previous year. The weather in the third quarter of 2022 (DWD) was very dry, which resulted in lower generation levels at that time.

Overall, feed-in from renewable sources was 9.6% higher than in the third quarter of 2022 and accounted for 59.6% of total generation* (Q3 2022: 44.9%).

The high amounts of generation combined with lower electricity consumption resulted in renewables accounting for 52.9% of electricity consumption (grid load) in the past quarter.

There was a decrease in generation from nearly all conventional energy sources. For example, generation from hard coal saw a decrease of 60.4% and generation from lignite was down 38.3% from Q3 2022. The reason for the decrease in generation from hard coal and lignite could be the overall decline in electricity generation due to the lower demand. There were also more instances of individual power stations on the electricity market being unavailable. For example, individual blocks of the Neurath lignite power station with capacities ranging from 100 MW to 1,061 MW were repeatedly unavailable.

Pumped storage generation was also down by 9.4% compared to the third quarter of 2022.

By contrast, natural gas generation was up by 36.7%. This was caused in part by changes in how Germany's four transmission system operators (TSOs) report their data.

The Bundesnetzagentur maintains close contact with the network operators to improve the quality of their data reports, especially regarding the levels of coverage, which are listed in the SMARD user guide. As part of this process, data reports were updated. Three of the four TSOs revised their figures for past periods downwards. At the same time, the fourth TSO is recording much higher figures using the new measurement methodology. That has led to a jump in the gas generating figures for 2023 compared with 2022. An update to the past data in this case, too, is under consideration.

There is also a basic explanation for the increase in gas-generated electricity. Gas prices peaked in the third quarter of 2022 at more than €300/MWh. Since then gas prices have fallen by 80%, which has also improved the profitability of gas-fired power plants in the electricity market. In the summer of 2023 a partial fuel switch between hard coal and gas took place. At equally high CO2 prices, gas-fired power plants with high efficiency passed hard coal-fired power plants in the merit order because they have lower marginal costs.

Another reason for the use of gas power plants is their flexibility. They can be switched off and fired up again much faster than coal plants.

Natural gas is also used to generate process and district heat and, for technical reasons, electricity is often produced at the same time. From the operators' perspective, it makes sense for combined heat and power (CHP) plants to continue producing electricity if they are responsible for supplying heat to an urban or industrial heating network and if it is not yet possible, or would be more expensive, to separate the heat generation from the electricity generation process.

Overall generation from conventional energy sources was down by 39.4%, partly due to the closure of the last nuclear power plants on 15 April of this year.

Total generation in the third quarter was down by 17.4% compared to Q3 2022.

Average wholesale electricity price decreased by more than 75%

Following Russia's invasion of Ukraine, there was a huge increase in prices on the wholesale markets for electricity, gas and coal. Electricity prices were extremely volatile and closely connected to gas price trends.

The main reason for the higher prices for electricity over the year was the increase in natural gas prices that occurred in the second half of 2021. Natural gas power plants set the price for many hours in European wholesale electricity trading. The last quarter of 2022 saw a decrease in electricity prices, which then continued in 2023.

The average day-ahead price on the electricity exchange in Q3 2022 was €375.75/MWh.

The price in Q3 2023 (€90.78) was well below a quarter of that amount. This is due to a higher share of renewable energy sources and lower fuel prices for coal and natural gas. At the same time continuous generation from conventional energy sources resulted more frequently in negative prices, which accordingly reduced the average price.

The return or continued operation of coal-fired plants to the market also brought down prices by increasing the amount of available capacity and supply in the market. In addition, the generating costs of gas-fired power plants have decreased because natural gas prices have also decreased.

Day-ahead wholesale electricity prices in Germany | ||

Q3 2023 | Q3 2022 | |

Average [€/MWh] | 90.78 | 375.75 |

Minimum [€/MWh] | -500.00 | -0.10 |

Maximum [€/MWh] | 524.27 | 871.00 |

Number of hours with negative prices | 101 | 2 |

The highest price (€524.27/MWh) was recorded on Monday 11 September between 7pm and 8pm. The high price was due to the large share of conventional energy sources (34.9 GWh) in electricity consumption (58.0 GWh). The price in that hour was above the average price of the neighbouring countries (€310.81/MWh).

The lowest price of negative €500/MWh was recorded on Sunday 2 July. Between 2pm and 3pm generation from renewable energy sources alone (49.5 GWh) was higher than electricity consumption (43.6 GWh). Conventional energy sources generated another 6.1 GWh during this hour and 4.1 GWh of electricity was used to fill pumped storage reservoirs.

There were negative prices in all countries with which electricity is traded except for Poland, Czechia and the northern Italian market area. The same price as in Germany (negative €500/MWh) was available in Hungary, Slovenia, Austria and the Netherlands.

Commercial foreign trade

In the third quarter of this year, Germany imported 13,727 GWh more electricity than it exported, making it a net importer. In Q2 2022, net exports totalled 3,200 GWh.

There is an interaction between supply and demand across the whole of Europe. Electricity is produced within Europe wherever it is cheapest. Germany and the other European countries can all benefit from the most favourable conditions for generation in each case. The wholesale electricity prices and trading are the result of this interplay. As a result, there may be times when it makes sense to import or export electricity for economic, rather than supply-related, reasons. Network capacity and stability also play a role in trading flows.

Wholesale electricity prices in other countries generally made it profitable in the past quarter to import electricity. For example, in trading with Switzerland, where there was a change in the direction of foreign trading compared with the third quarter of 2022, electricity from Switzerland was less expensive in 1,223 of the 2,208 hours of trading. The chart below shows the price levels in Germany and Switzerland as well as the trading flows:

An overview of Germany's commercial foreign trade of electricity in Q3 2023:

- Belgium:

Export: 694.8 GWh Import 1,459.5 GWh - Denmark 1:

Export: 521.9 GWh Import 3,604.3 GWh - Denmark 2:

Export: 257.2 GWh Import 1,269.7 GWh - France:

Export: 2,016.5 GWh Import 3,634.0 GWh. - Luxembourg:

Export: 867.4 GWh Import: 28.2 GWh. - Netherlands:

Export: 842.3 GWh Import: 2,822.8 GWh. - Norway:

Export: 190.0 GWh Import: 2,132.9 GWh. - Austria:

Export: 1,401.2 GWh Import: 1,373.6 GWh. - Poland:

Export: 696.8 GWh Import: 840.4 GWh - Sweden:

Export: 50.5 GWh Import: 961.0 GWh - Switzerland:

Export: 1,286.5 GWh Import: 3,733.3 GWh. - Czech Republic

Export: 693.9 GWh Import: 1,386.3 GWh

_____________________________________________________________________________________________________________

*The actual generation is the net electricity generation. It is the electricity fed into the general supply network less the electricity consumed by power plants themselves. It does not include electricity generated in the Deutsche Bahn network or within industrial networks and closed distribution networks.