Hint: This website is not optimized for your browser version.

Increase in wholesale prices for electricity - Electricity generation and electricity trading in June 2020

10 July 2020 - Compared with the same month of the previous year, electricity generation and electricity consumption in Germany were down 4.9% and 8.1% respectively. The average wholesale price was €26.18/MWh, which was lower than the average price in the same month of the previous year, although it was at its highest since January. In June, Germany imported 232.8 GWh more electricity than it exported, making it an overall net importer.

Compared with May, electricity consumption was down in June by nearly 13%, which can be explained in part by the month having one less calendar day. Compared with the same month of the previous year, electricity consumption declined by 8.1%.

Electricity generation from renewable and conventional energy sources totalled 35.4 TWh in June (2019: 37.2 TWh). Generation from conventional sources was 3.7% lower than in June 2019 and from renewable sources it was 6.2% lower.

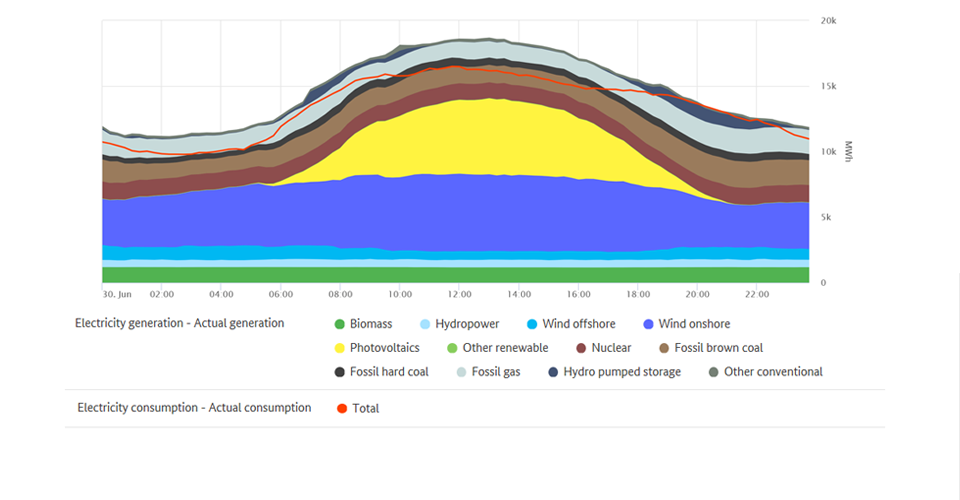

The chart illustrates electricity generation and consumption in Germany in the month of June.

The decrease in electricity generation from conventional sources is mainly due to the reduced usage of black coal (-44.2%) and lignite (-16.1%). In contrast, generation from nuclear power increased by 1.9% and from natural gas by 42.1%.

One possible reason for the overall lower electricity generation could be the decrease in electricity consumption during the coronavirus pandemic. There are also other factors in individual plant dispatch planning in the European electricity market, for example fuel costs or CO2 certificate prices, which impact the relative costs of a country’s fossil electricity generation. Changes in the installed and available capacity are also not negligible.

Natural gas plants that emit less CO2 than coal-fired plants can also benefit from the current low fuel prices. Increasingly, what is known as the “fuel switch” takes effect. This is when gas-fired plants take the place of coal-fired plants in the merit order and set the prices in the wholesale market. This is why, according to the operator, both of the gas-fired power generation units Irsching 4 and 5 in southern Germany will soon be recommissioned. They were idle for years due to prohibitively high costs for fuel and CO2 certificates.

On Tuesday 30 June between 12pm and 1pm, when electricity consumption was high at 65.3 GWh, total electricity generation reached its maximum of just under 74.1 GWh, which was 1.9% beneath the maximum value in the same month a year earlier. Electricity generation recorded its lowest level of 27.4 GWh on Sunday 21 June between 4am and 5am, when electricity consumption was also low at 33.8 GWh.

Highest and lowest outputs of renewable electricity generation

Electricity generation from renewable energy sources reached its highest level of 55.7 GWh on Tuesday 30 June between 1pm and 2pm. Photovoltaic systems generated 22.9 GWh (41%), onshore wind farms 23.2 GWh (42%) and offshore wind farms 2.6 GWh (4.7%). The remaining 7 GWh (12.3%) came from biomass, hydropower and other renewables. Electricity consumption during this hour was at 64.3 GWh. As reflected in the above figures, renewables covered nearly 87% of electricity consumption, ie the grid load, during this hour. On Monday 1 June between 12pm and 4pm renewables were able to continuously meet the demand for electricity.

With little wind in the night, generation from renewable sources fell to its lowest level of 7.1 GWh on Wednesday 17 June between 2am and 3am, when electricity consumption was low at 39.1 GWh. At 4.1 GWh, biomass accounted for the majority (58%) among the renewables; hydropower generated 2.2 GWh (31%); on and offshore wind farms together generated only 0.7 GWh (10%); photovoltaic systems and other renewables generated the remaining 0.1 GWh (1%).

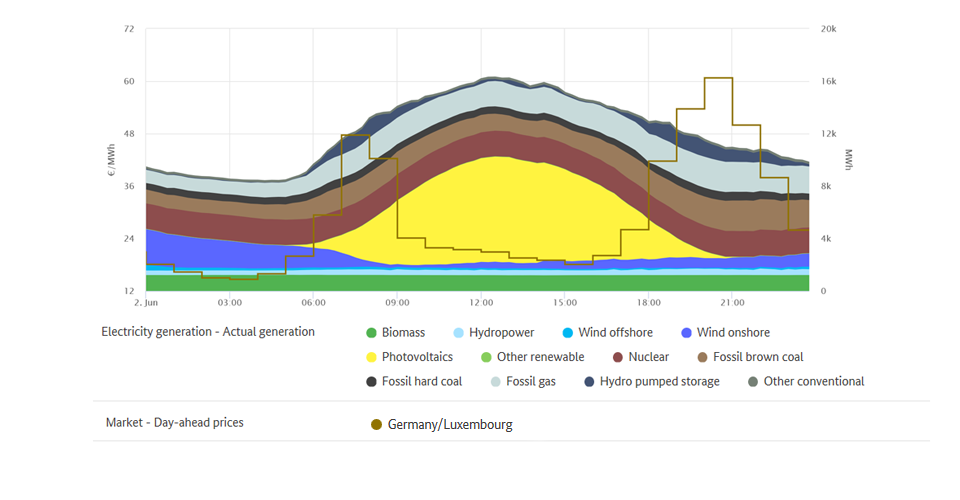

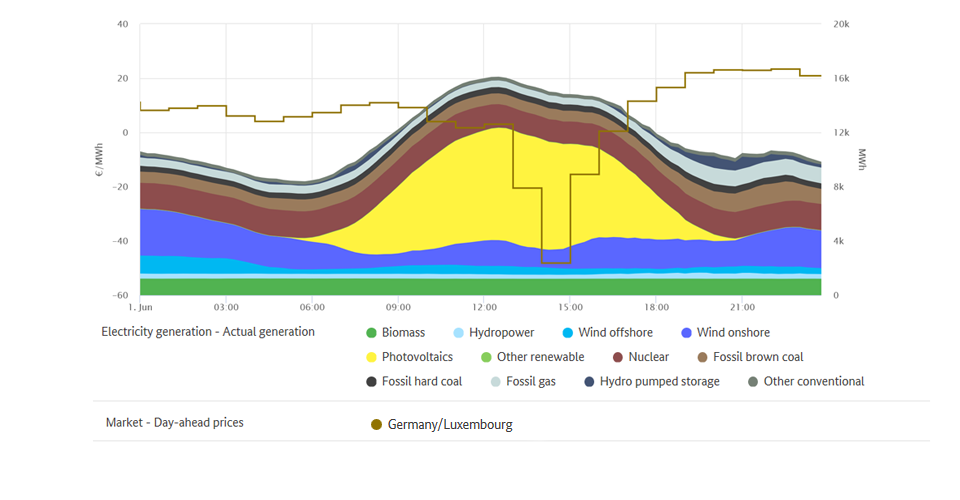

The chart shows electricity consumption and renewable electricity generation on 1 June 2020. Between 12pm and 4pm they were able to fully meet the demand (grid load).

The wholesale electricity price in Germany

Compared with the previous year, wholesale prices for electricity fell. In June, the hourly products on the EPEX Spot day-ahead market were traded at between minus 48.17 and plus 60.75 euros per megawatt hour (€/MWh), resulting in an average price of €26.18/MWh. This was on average 6.33 euros lower than in the same month of the previous year (June 2019: €32.52/MWh), although again at its highest since January. Reasons for the upward movement this year are, among others, the lower renewable energy output and the lower number of negative prices than was recently the case.

The lowest exchange price was recorded between 2pm and 3pm on Monday 1 June at minus €48.17/MWh). During this time, the total electricity consumption of 43.1 GWh was met completely by the higher level of renewable generation of 45.0 GWh. At the same time, conventional generation was low at 14.7 GWh.

The number of hours with negative electricity prices was less than one third the amount compared with the same month of the previous year: the figure decreased from 26 to 8 of the 727 hours of trading.

In the previous year, on Monday 8 June, a public holiday, negative prices were recorded in 19 consecutive hours. In addition to low electricity consumption with high renewable energy output and inflexible conventional generation, IT problems on the electricity exchange at that time led to a partial decoupling of the European markets. This made the electricity prices generally lower. The "six-hour rule" did not take effect in June, meaning that larger new installations receiving payments under the Renewable Energy Sources Act (EEG) and selling electricity directly continued to receive payment in these periods. Under the rule, only if the day-ahead price on the electricity exchange is negative for a period of at least six consecutive hours, do the installation operators not receive the market premium as from the first hour in the period with negative prices.

On the day-ahead market, the highest price of the past month of €60.75/MWh was recorded on Tuesday 2 June between 8pm and 9pm. In this hour, electricity consumption was high at 53.2 GWh and there was a low level of generation from renewables (11.0 GWh). The electricity market reacts to this kind of situation by taking power from storage facilities (such as pumped storage stations), reducing the consumption of flexible loads and increasing the use of conventional power stations.

Wholesale prices in Germany | ||

June 2020 | June 2019 | |

Average [€/MWh] | 26.18 | 32.52 |

Minimum [€/MWh] | -48.17 | -90.01 |

Maximum [€/MWh] | 60.75 | 76.50 |

Number of hours with negative prices | 8 | 26 |

data basis: smard.de

Commercial foreign trade

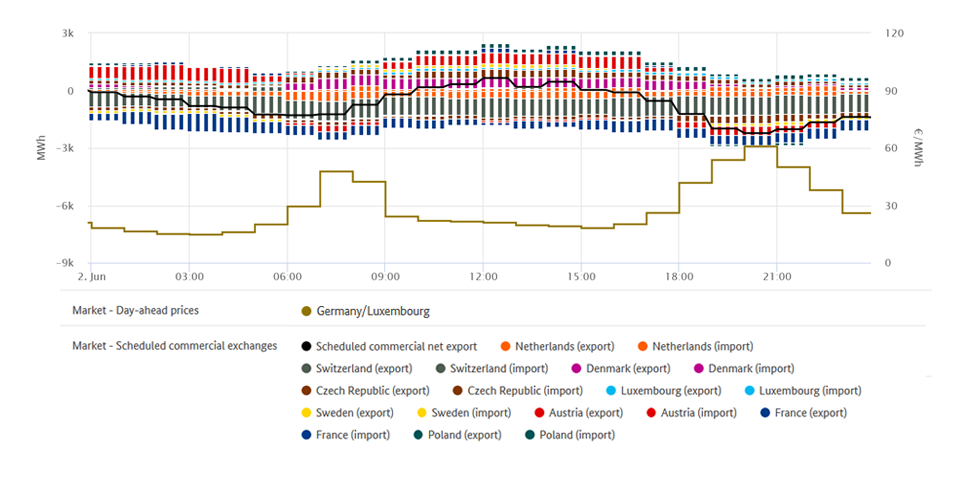

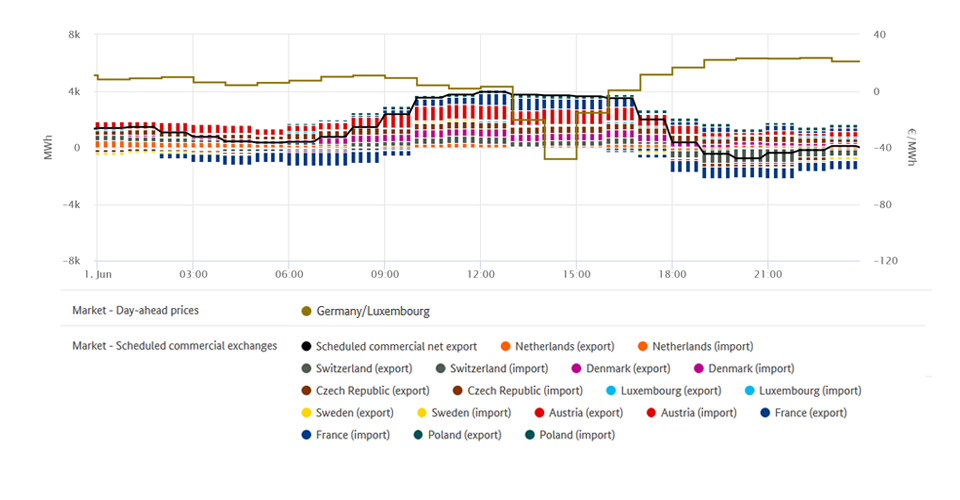

Germany imported a total of 232.8 GWh more electricity than it exported, making it an overall net importer, as was the case in April (596.4 GWh) and May (2,079 GWh). In the same month of the previous year net imports were 807.1 GWh and hence fell significantly this June.

Changes in imports and exports are the result of frequent price fluctuations, which reflect the interaction of supply and demand in the respective countries and across borders. These fluctuations are part of normal market activity in European wholesale electricity trading.

For example, as was already the case in May, consumption was lower in June than in the same month of the previous year due to the coronavirus crisis. But consumption in Germany declined in this month more sharply than generation.

A total of 1.2 TWh were exported, which corresponds to 3.4% of the electricity that was produced in this time frame in Germany. The main customer for Germany's net exports of electricity (exports less imports) was Poland, which accounted for 437 GWh (up 70% compared with the previous year). Denmark followed in second place with 325 GWh (down 34%), ahead of Luxembourg with 302 GWh (down 12%).

One reason for the large increase in exports to Poland was the number of hours in which electricity from Germany was cheaper. This was the case in 714 of the 720 hours of trading. Fossil energy sources dominate electricity generation in Poland. Black coal alone makes up 51% of the installed generating capacity, lignite another 17%. That makes the electricity traded there relatively expensive, among other reasons due to the increased prices for CO2 certificates.

Germany was a net importer from Switzerland (986 GWh; 6% more imports compared with the previous year), France (365 GWh; down 66%) and Sweden (121 GWh; down 45%).

One reason for the decline in imports compared with the previous year could be the smaller number of hours in which wholesale prices in the neighbouring countries were lower compared to wholesale prices in Germany. This June there were 410 hours (450 hours in 2019) when electricity from Switzerland was less expensive than in Germany, and 391 hours (503 hours in 2019) when electricity from Sweden was less expensive than in Germany.

The number of hours in which electricity from France was less expensive than from Germany was 147, less than half the number from the previous year (2019: 353 hours). While electricity generation there declined overall by around 15.1%, the reason why the French prices nevertheless remained higher could lie in the fact that generation from nuclear power declined by 25.3%, while generation from gas, with its higher fuel costs, increased by 41.5%.

The Fessenheim nuclear power station was permanently taken off the grid on 29 June. Further nuclear power station closures are to follow till 2035.

The chart gives an overview of Germany's commercial electricity trade. (Gross) exports are shown above the zero line while (gross) imports are shown below the zero line.